Accountability report 2022/23

This information is part of our Annual report and accounts 2022/23

Our Accountability Report outlines key features of how we manage our organisation. It has three sections.

Over the following pages our Corporate Governance report explains who our Board and senior management team are, how they work and the governance arrangements in place to ensure effective management and oversight of our resources to achieve our objectives.

Our Remuneration and Staff Report describes how we address Board and senior management pay as well as providing an overview of the make-up of our staff numbers.

Our Parliamentary Accountability and Audit Report brings together additional requirements requested to demonstrate our accountability to the UK and Welsh Governments, regularity of expenditure and the opinion from our external auditor.

Corporate Governance Report

Directors’ Report

The Chief Executive is supported by a team of Executive Directors who together form our Executive Team (ET). There have been no changes to the Executive Team during 2022/23.

|

Name |

Post Holder |

Length of ET Service |

|---|---|---|

|

Chief Executive |

Clare Pillman |

26 February 2018 - present |

|

Executive Director of Evidence, Policy and Permitting |

Ceri Davies |

1 April 2013 - present |

|

Executive Director of Finance & Corporate Services |

Rachael Cunningham |

7 September 2020 – present |

|

Executive Director of Operations |

Gareth O’Shea |

27 April 2015 – present |

|

Executive Director of Corporate Strategy and Development |

Prys Davies |

1 April 2019 – present |

|

Executive Director of Communications, Customer and Commercial |

Sarah Jennings |

7 September 2020 – present |

Our Executive Team Register of Interests as at March 2023 is included here.

|

Name |

Position |

Interest |

Individual |

Role |

|---|---|---|---|---|

|

Clare Pillman |

Chief Executive |

Resident in an area that may be considered for the proposed new National Park |

Personal |

N/A |

|

Clare Pillman |

Chief Executive |

Executive or Non-Executive Board, Committee or Trust Membership |

Personal |

Member of Welsh National Opera Board |

|

Ceri Davies |

Executive Director of Evidence, Policy and Permitting |

Other |

Personal |

Member of the Chartered Institute of Waste Management |

|

Prys Davies |

Executive Director of Corporate Strategy and Development |

Executive or Non-Executive Board, Committee or Trust Membership |

Personal |

School Governor, Ysgol Pencae, Cardiff |

|

Gareth O’Shea |

Executive Director of Operations |

No interests to declare |

N/A |

N/A |

|

Rachael Cunningham |

Executive Director of Finance & Corporate Services |

Executive or Non-Executive Board, Committee or Trust Membership |

Personal |

Trustee of Chwarae Teg Charity |

|

Sarah Jennings |

Executive Director of Communications, Customer and Commercial |

Executive or Non-Executive Board, Committee or Trust Membership |

Personal |

Trustee of National Botanic Garden of Wales |

|

Sarah Jennings |

Executive Director of Communications, Customer and Commercial |

Executive or Non-Executive Board, Committee or Trust Membership |

Personal |

Trustee of Community Foundation Wales |

The Chair’s declaration of interests has been reviewed by both the incoming and outgoing Chair of the Audit and Risk Assurance Committee and the Head of Governance & Board Secretary.

The Register of Interests for our Board members is available on our website under Register of Interests.

- Clare Pillman, Chief Executive and Accounting Officer - 18 October 2023

Statement of Accounting Officer’s Responsibilities

Paragraph 23 (1) of the Schedule to the Natural Resources Body for Wales (Establishment) Order 2012 requires NRW to produce, for each financial year, a Statement of Accounts in the form and on the basis set out in the Accounts Direction. The accounts are prepared on an accruals basis and must give a true and fair view of the state of affairs of NRW and of the income and expenditure, changes in taxpayers’ equity and cash flows for the financial year.

In preparing the accounts, the Accounting Officer is required to comply with the requirements of the Government Financial Reporting Manual (FReM) and to:

- observe the Accounts Direction issued by HM Treasury including the relevant accounting and disclosure requirements and apply suitable accounting policies on a consistent basis

- make judgements and estimates on a reasonable basis

- state whether applicable accounting standards as set out in the FReM have been followed, and disclose and explain any material departures in the financial statements

- prepare the financial statements on a going concern basis

- confirm that there is no relevant audit information of which NRW’s auditors were unaware, and take all steps to make themselves aware of any relevant audit information and to establish that NRW’s auditors are aware of that information

- confirm that the Annual Report and Accounts as a whole is fair, balanced and understandable and take personal responsibility for it and the judgements required for determining that it is fair, balanced, and understandable.

The Additional Accounting Officer for the WG has designated the Chief Executive of NRW as its Accounting Officer. The Chief Executive’s responsibilities as Accounting Officer are the propriety and regularity of the public finances for which she is answerable; the keeping of proper accounts; prudent and economical administration; avoidance of waste and extravagance; and the efficient and effective use of all the resources as set out in the Memorandum for the Accounting Officer for NRW.

Governance Statement

This Statement sets out the governance structures, internal control and assurance frameworks that have operated within NRW during the financial year 2022/23 and accords with HM Treasury and Managing Welsh Public Money guidance.

As the designated Accounting Officer for NRW, my role is also to safeguard public funds and organisational assets by putting in place arrangements for the governance of our affairs and effective exercise of our functions. I can confirm that the information in our Annual Report and Accounts is a true and fair account of how the organisation has delivered its functions this year. I also confirm that there is no outstanding information that has been brought to my attention or that I am aware of that has not been brought to the attention of Audit Wales.

Our governance structure

Our organisational structure shows how we are set up to work and deliver our objectives.

Our Board members are appointed by Welsh Ministers in accordance with the Code of Practice for Ministerial Appointments in Public Bodies, and as such our Chair is accountable to our sponsor minister in the WG.

We currently have 13 remunerated Board members, led by our Chair, Sir David Henshaw, with 11 non-executive members and myself as an executive member of the Board. Professor Steve Ormerod is the appointed Deputy Chair of NRW and Julia Cherrett is the Senior Independent Director (SID). The role of SID was introduced to support the Chair in his role; to act as an intermediary for other nonexecutive directors when necessary; to lead the non-executive directors in the oversight of the Chair and to ensure there is a clear division of responsibility between the Chair and Chief Executive. There were seven changes to our Board this year: the term of Paul Griffiths ended on 25 May 2022, Catherine Brown’s term ended on the 8 November 2022 and Karen Balmer’s term ended on 31 March; Professor Peter Fox and Helen Pittaway were appointed as non-executive Directors from 16 February 2023; Kathleen Palmer was appointed as Non-Executive Director from 1 April 2023; and Professor Rhys Jones was appointed as Non-Executive Director from 9 May 2023.

To carry out our duties, we meet as a full Board with additional scrutiny being undertaken by seven committees. Our Executive Team (ET) provides strategic and operational updates to our Board and committees for scrutiny and decision as required.

Each committee is chaired by a non-executive Board member and, with the exception of the Evidence Advisory Committee (EAC), each includes at least three other non-executive Board members. Other non-executive Board members have an open invitation to attend committee meetings in a non-voting capacity. We do not have a Nominations Committee, as our non-executive Board members are appointed by Welsh Ministers. The following sections outline the work focus areas and attendance of our Board and committees.

|

Non-Executive members |

Term |

Start date |

Current end date |

|---|---|---|---|

|

Sir David Henshaw (Chair) |

2 |

1 November 2018 |

31 October 2025 |

|

Professor Steve Ormerod |

2 |

1 November 2018 |

31 October 2025 |

|

Karen Balmer |

2 |

9 November 2015 |

31 March 2023 |

|

Catherine Brown |

1 |

1 November 2018 |

31 October 2022 |

|

Julia Cherrett |

2 |

1 November 2018 |

31 May 2023 |

|

Zoe Henderson |

2 |

9 November 2015 |

8 May 2023 |

|

Professor Peter Rigby |

2 |

1 November 2018 |

31 October 2023 |

|

Professor Calvin Jones |

2 |

1 September 2021 |

31 October 2028 |

|

Mark McKenna |

2 |

1 September 2021 |

31 October 2028 |

|

Paul Griffiths |

1 |

1 September 2021 |

25 May 2022 |

|

Dr Rosie Plummer |

2 |

1 November 2018 |

31 October 2024 |

|

Geraint Davies |

2 |

1 January 2019 |

31 October 2024 |

|

Professor Peter Fox |

1 |

1 February 2023 |

31 October 2026 |

|

Helen Pittaway |

1 |

1 February 2023 |

31 October 2026 |

|

Kathleen Palmer (Served as an Associate Board Member from 16 February 2023 until the commencement of their full Board Member roles.) |

1 |

1 April 2023 |

31 October 2026 |

|

Professor Rhys Jones (Served as an Associate Board Member from 16 February 2023 until the commencement of their full Board Member roles.) |

1 |

9 May 2023 |

31 October 2027 |

Board Meetings

We held six two-day meetings; two were held virtually and four were held face to face following the easing of the lockdown restrictions that were implemented during the Covid-19 pandemic. Members of the public were once again able to attend and observe at the face to face meetings. Standing items on our agenda include: in-year finance; performance reporting; response to Climate and Nature Emergencies; and strategic and operational updates from the Chair, Chief Executive and committees.

We publish a wide range of information regarding our work on our website, including papers to be considered by the Board in advance of those meetings held in public. Board papers are prepared using the latest evidence available and receive internal scrutiny and approval prior to Board meetings.

All future meeting dates and previous agendas are available on our website, as well as the papers and minutes from our public sessions.

Board member attendance 2022/23

|

Name |

Meeting Attendance |

|---|---|

|

Sir David Henshaw (Chair) |

5 out of 6 |

|

Professor Steve Ormerod |

6 out of 6 |

|

Karen Balmer |

6 out of 6 |

|

Catherine Brown |

2 out of 3 |

|

Julia Cherrett |

6 out of 6 |

|

Geraint Davies |

6 out of 6 |

|

Zoe Henderson |

6 out of 6 |

|

Professor Calvin Jones |

6 out of 6 |

|

Mark McKenna |

5 out of 6 |

|

Paul Griffiths |

N/A |

|

Dr Rosie Plummer |

5 out of 6 |

|

Professor Peter Rigby |

6 out of 6 |

|

Professor Peter Fox |

1 out of 1 |

|

Helen Pittaway |

1 out of 1 |

|

Kathleen Palmer |

1 out of 1 |

|

Professor Rhys Jones |

1 out of 1 |

|

Clare Pilman (Chief Executive) |

6 out of 6 |

Audit and Risk Assurance Committee

The Audit and Risk Assurance Committee’s (ARAC) principal role is to advise the Board and support the Accounting Officer in monitoring, scrutinising and challenging the arrangements in place for audit, governance, internal controls and risk management. Following the end of Catherine Brown’s term as a Board Member on 8 November 2022, Karen Balmer took over as the Chair of this Committee. At the end of Karen Balmer’s term as a Board Member on 31 March, Kathleen Palmer became the Chair of this Committee. The Chief Executive attends every meeting as NRW’s Accounting Officer, along with our Executive Director of Finance and Corporate Services. Members of ET now attend the committee to discuss any limited assurance internal audit reports.

This year ARAC addressed a range of issues including:

- Improvements to our risk management approach

- Organisational assurance mapping

- Internal Audit Plan 2022/23

- Annual Report and Accounts 2021/22 and plans for this report, 2022/23

- Cyber risk

Board member ARAC attendance 2022/23

|

Name |

Number of meetings |

Number of full meetings attended |

|---|---|---|

|

Catherine Brown (Chair, to November 2022) |

3 |

3 |

|

Karen Balmer (Chair, from November 2022 to March 2023) |

6 |

5 |

|

Kathleen Palmer (Chair, from April 2023) |

1 |

1 |

|

Dr Rosie Plummer |

6 |

4 |

|

Professor Peter Rigby |

6 |

6 |

People and Customer Committee

The People and Customer Committee (PCC) (formerly the People and Remuneration Committee) considers matters relating to people management, reward, and organisational change. This includes oversight of the pay and conditions of employment of the most senior staff, an overall pay strategy for all staff employed by NRW, pension scheme provision, organisational design, wellbeing, health and safety, customer care, equality and diversity and development of the Welsh language scheme. Following the end of Zoe Henderson’s term as Chair in June 2022, Julia Cherrett took over as the Chair of this Committee. At the end of Julia Cherrett’s term as Chair of this Committee in March 2023, Mark McKenna became the Chair of the Committee. The Chief Executive attends every meeting.

The Committee addressed a range of issues during the year including:

- Wellbeing, Health and Safety and Serious Incident Reviews

- Scrutiny of proposed People Management policies

- Recruitment and the Recruitment Process

- Customer Journey Mapping

- Organisational Succession Planning

- Customer Experience and Engagement Strategy

- Renewal Programme

Board member PCC attendance 2022/23

|

Name |

Number of meetings |

Number of full meetings attended |

|---|---|---|

|

Zoe Henderson (Chair, to June 2022) |

4 |

4 |

|

Julia Cherrett (Chair, from June 2022 to March 2023) |

4 |

4 |

|

Karen Balmer |

4 |

4 |

|

Mark McKenna (Chair, from March 2023) |

4 |

3 |

Finance Committee

The Finance Committee provides advice, oversight, and scrutiny on strategy, management and performance in relation to finance, business planning and performance, charge schemes, and commercial matters. In carrying out its role, the Committee focuses on strategic direction and development, however it also has a role in scrutinising performance and delivery. Sir David Henshaw has been acting as the Interim Chair of the Committee and was replaced by Helen Pittaway from March 2023.

This year the Committee considered the following:

- Monitoring in-year financial performance

- Financial and Business Planning for 2023/24

- Strategic Review of Charging

- Timber sales and marketing oversight

- NRW’s Baseline exercise

- Grants strategy

- Procurement and Contracts funding framework

Board member Finance Committee attendance 2022/23

|

Name |

Number of meetings |

Number of full meetings attended |

|---|---|---|

|

Sir David Henshaw (Interim Chair, to March 2023) |

6 |

6 |

|

Helen Pittaway (Chair, from March 2023) |

1 |

1 |

|

Julia Cherrett |

5 |

3 |

|

Paul Griffiths |

1 |

1 |

|

Professor Calvin Jones |

6 |

6 |

|

Dr Rosie Plummer |

6 |

5 |

Protected Areas Committee (PrAC)

The Board has delegated its statutory responsibilities in relation to legislation concerned with nature conservation and protected landscapes to the Protected Areas Committee (PrAC). PrAC members also support the Executive and Board by providing advice on wider protected area issues and strategic casework, including landscape management, Designated Landscapes, and NNRs.

PrAC reviewed areas including NRW’s role as the designator for a proposed new National Park, the Biodiversity Policy, and Protected Sites delivery.

Board member PrAC attendance 2022/23

|

Name |

Number of meetings |

Number of full meetings attended |

|---|---|---|

|

Dr Rosie Plummer (Chair) |

3 |

3 |

|

Geraint Davies |

3 |

2 |

|

Professor Steve Ormerod |

3 |

3 |

|

Mark McKenna |

3 |

3 |

Flood Risk Management Committee

The Committee is advisory and reports to the NRW Board.

Its primary responsibilities are to scrutinise Flood Risk Management (FRM) investment programmes for current and future years, and to consider key issues which may affect the delivery of FRM related work in Wales. Following the end of Julia Cherrett’s term as Chair in March 2023, Professor Peter Fox took over as the Chair of this Committee.

The Committee usually comprises four non-executive members of the Board along with the Executive Director for Finance and Corporate Services, Executive Director for Evidence, Policy and Permitting, Head of Flood and Incident Risk Management and Head of Finance.

FRMC reviewed areas including:

- Prioritisation of flood risk management activities

- Governance of the flood risk management capital programme

- Oversight of the flood recovery and review implementation programme

- skills and succession planning

- Oversight of work to improve NRW’s regulation of reservoir safety

- Asset Management

Board member FRMC attendance 2022/23

|

Name |

Number of meetings |

Number of full meetings attended |

|---|---|---|

|

Julia Cherrett (Chair, to April 2022, and from May 2022 to March 2023) |

4 |

4 |

|

Paul Griffiths (Chair, April to May 2022) |

1 |

1 |

|

Professor Peter Fox (Chair, from March 2023) |

N/A |

N/A |

|

Geraint Davies |

4 |

2 |

|

Professor Calvin Jones |

4 |

3 |

Evidence Advisory Committee

The Evidence Advisory Committee (EAC) is advisory and provides independent advice and challenge in relation to NRW’s evidence function. The Committee also helps to strengthen understanding in the wider research community, and with evidence users in government, of evidence processes and priorities.

The Committee comprises two non-executive members of the Board, seven independent external members, the Executive Director of Evidence, Policy & Permitting and the Head of Knowledge and Evidence.

EAC reviewed areas including:

- NRW’s State of Natural Resources Report

- NRW’s role as the designator for a proposed new National Park

- Natural Flood Management Techniques

- NRW’s approach to Citizen Science

- Open Science Data

Board member EAC attendance 2022/23

|

Name |

Number of meetings |

Number of full meetings attended |

|---|---|---|

|

Professor Peter Rigby (Chair) |

3 |

3 |

|

Professor Steve Ormerod |

3 |

3 |

Land Estate Committee

The Land Estate Committee (LEC) met for the first time in January 2023 and it is Chaired by Professor Calvin Jones. The Committee’s principal role is to advise the Board on the sustainable management of NRW’s land estate, including investment in the estate, its management, and proposals for changes in its use.

LEC reviewed areas including the Recreation Strategy and the Renewable Energy Developer Initiative.

Board member LEC attendance 2022/23

|

Name |

Number of meetings |

Number of full meetings attended |

|---|---|---|

|

Professor Calvin Jones (Chair) |

1 |

1 |

|

Dr Rosie Plummer |

1 |

1 |

|

Geraint Davies |

1 |

1 |

|

Mark McKenna |

1 |

1 |

Board Member reviews

The Chair carries out annual appraisals with each Non-Executive Director and the Chief Executive, and the review process includes a short self-assessment and priorities for the next year. The Chief Executive undertakes mid- and end-year appraisals with the five Executive Directors.

Our Executive

Day-to-day management of our organisation is delivered through the ET, comprising myself as Chief Executive and five Executive Directors who report to me. ET meet twice each month to consider core corporate business, for example finance updates, performance information, wellbeing health and safety, review and scrutinise the strategic risk register, etc. They also scrutinise and consider decisions concerning strategy, policy, and operational issues.

Below ET, our Leadership Team plays a leading role in managing the business on a day-to-day basis. Its members are all the Heads of departments that report to our ET including those in our corporate functions (such as Finance, HR, and Communications).

Our structure emphasises place-focussed delivery: seven Heads of Place within the single Operations Directorate each oversee delivery of all our functions in a specific region of Wales. We then have nominated Heads of Service (who are each also a Head of Place) who take a lead for overseeing delivery of a particular function throughout Wales. The Heads of Service work closely with our policy leads - called Heads of Business – who oversee the strategic direction of our work across Wales.

To ensure a join up between strategic thinking and operational delivery, we have a series of Business Boards which set the policy requirements and plan the operational nature of our work across the place-focussed structure. These are each led by the Head of Business / Head of Service.

Our Corporate Plan sets out our Well-being Objectives and the steps we will take to deliver them. In the annual business plan, we outline how we will take forward those steps to take in the year ahead.

This business plan for 2022/23 is the last aligned to the Corporate Plan for 2017/23. Over the course of the last 18 months there have been significant changes in the strategic policy context within which we work, with the declaration of the climate and nature emergencies and landmark evidence reports published ahead of COP 26 and COP15. This informed debate at our Board and with Ministers, and resulted in the Board agreeing five strategic priorities reflecting the strategic discussions led by our Board as well as five priorities agreed for the year with Ministers. These Strategic and Ministerial priorities related to 2022/23 only, while we developed our new Corporate Plan aligned to the term of Government remit letter.

2022/23 was a year of transition for NRW and through the course of the year we have been putting in place the corner stones for the future of our organisation. This business plan responds to the Government’s ambition, but also recognises the ongoing budgetary pressures across the public sector. We have worked with ministers and officials through 2022/23 to build a common understanding of our resources, priorities and the appetite and opportunity for doing things differently. In working through this process, we are grateful to ministers for sustaining the level of funding for 2022/23 so we were able to maintain the service we provide.

We brought this work to a conclusion over the course of the year to ensure that the outputs informed the WG budget setting process for 2023/24.

Through the year we have been involving staff, our Board and partners in the preparation of the next Corporate Plan, with workshops and a series of engagement events running through the year, culminating in the launch of the Corporate Plan in March 2023. In this new Corporate Plan, we set out where NRW is best placed to make a difference within the resources we have, but also where we will need to adapt how and where we work, and innovate and collaborate to bring about a change that is fair, just and ensures nobody gets left behind.

As a category 1 responder under the Civil Contingencies Act (2004) we have continued to carry out our duties in a professional and effective way, responding to a significant number of incidents within our remit as well as supporting our multiagency partners as appropriate with wider incidents. We have continued to train and develop staff to enable them to support our duty rotas, following our contractual change made last year, as a result we have more staff now available to support our incident response in and out of hours and continue to train more staff to further bolster rotas for the future. Staff have attended a number of internal and external incident exercises and we continue to build on the learning from them and from actual incidents to improve our capabilities and the service we provide, as we face the challenges and increased number of incidents resulting from the climate and nature emergencies.

Ministerial Directions

We have not received any Ministerial Directions this year.

Our Internal Control Framework

Our internal control framework consists of policies, procedures, measures, and accreditations we have in place to protect our resources while we deliver our objectives

Our key financial controls within automated systems and our schemes of delegation to ensure appropriate segregation of duties remain in place and current. The ‘Managing our Money’ and ‘NRW Statutory and Legal Scheme’ documents are both reviewed regularly. Where significant changes had been implemented new controls were identified, for example managers were asked to maintain ICT asset lists of additional items which were taken home to support increased and sustained working from home.

Risk Management

A robust risk management framework is an essential component of our governance framework. It assists us in managing our business, protecting our resources and our reputation.

Our risk management framework focuses on identifying, assessing, managing and reporting on our risks within our risk appetite, and draws, as relevant, upon a number of recognised risk management standards.

Our Strategic risk register is owned by our ET with each risk being owned by an individual Director, supported by Leadership or Management level risk manager(s). Our strategic risks are regularly reviewed by the Executive level risk owners, and by the ET collectively. The strategic risks are subject to deep dives undertaken by the relevant Board Committee with the Board reviewing the complete strategic risk register on an annual basis.

Oversight of the risk management framework and its effectiveness is undertaken by the Audit and Risk Assurance Committee (ARAC) and they, in turn, provide assurance to the Board.

Our risk strategy is set and reviewed annually by the Board. This is underpinned by our organisational risk management RACI, clearly setting out accountabilities and responsibility for various aspects of our risk management framework, as well as those who need to be both informed or consulted in relation to risk management matters. Our risk management policy and associated guidance for staff is set and reviewed annually by our ET. Our risk management framework clearly sets out how and when risks should be escalated. This has been used in practice throughout the year.

Each of our strategic risks has a risk appetite level assigned to it by the Board, with a specific risk appetite statement providing more in-depth summary of how the risk appetite applies to that specific risk. As part of our structured risk management training programme, risk appetite training sessions have been delivered throughout the year to enable risk owners to understand how to apply appetite to their risks on registers throughout the organisation. The risk appetite is reviewed annually by the Board alongside the strategic risk register.

Throughout the year, we have worked on enhancing our risk management offer to the organisation, updating and embedding the tools in place to support risk management practices, including the risk register template, which now includes sections that focus on the effectiveness of our controls and planned mitigations, and whether they are working as intended.

Information assurance

We are committed to ensuring data and information is well governed and managed, and that we continue to achieve a balance between openness and security, making sure that staff and customers are assured of suitable levels of protection. The Senior Information Risk Owner (SIRO) continues to lead an integrated programme of work to strengthen our response to resilience against cyber and information security threats. We have once again passed our annual Cyber Essential Plus accreditation which is approved by the National Cyber Security Centre and independently audited by a qualified third-party specialist. We will continue to deliver a cyber security programme of work based on our cyber strategy. This includes initiatives for improving staff awareness, including cyber security online training. We also undertaking quarterly table top exercises to test our procedures and response to an Information Security incident.

We have mandatory bi-annual online learning courses for staff on UK General Data Protection Regulation (GDPR), Computer Security in the Workplace and Information Security to ensure everyone is aware and up to date on how we manage the information we receive and hold. Completion rates of mandatory online learning continue to improve with these being supplement with targeted awareness sessions. We continue to collaborate with strategic partners such as WG, Data protection Community, local resilience forum and the National Cyber Security Centre to share learning and maintain standards.

This year I was pleased that we have had no information breaches which were reportable to the Information Commissioners Office (ICO).

Number of cases reported to the Information Commissioner’s Office (ICO)

| Year | Number of cases |

|---|---|

| 2022/21 | 0 |

| 2021/22 | 0 |

| 2022/23 | 0 |

Declaration of Interest

Our Conflict of Interest policy and guidance support all staff and Board members with our continuous process to declare relevant personal interests to help us manage any potential or perceived conflicts with their professional roles. Following an Internal Audit review in 2020/21 significant improvements have been made to our Conflict of Interest policy, procedures, training, and reporting mechanisms.

Whistleblowing

Whistleblowing within NRW

We are committed to the highest standards of openness, probity, and accountability. There is an expectation that all those who work for NRW who have serious concerns about any aspect of NRW’s work is able to come forward and voice those concerns. NRW is committed to taking whatever action is necessary to address any wrongdoing which is uncovered.

Therefore, we have established measures in place to raise serious concerns about malpractice or impropriety. Our framework includes access to a telephone hotline and on-line form, where concerns can be raised anonymously if preferred.

During 2022/23 there were 20 potential whistleblowing cases reported via the whistleblowing mechanisms. All were considered in line with NRW’s whistleblowing policies and procedures. Of these 20 reports, 7 were reviewed and handled formally as whistleblowing cases, 9 related to matters outside of NRW and 4 were not considered as whistleblowing, as defined by NRWs Whistleblowing Policy, so were referred back to the business for internal handling.

Of the 7 cases handled formally as whistleblowing cases, 5 were not upheld and 2 are pending completion of the investigation.

Number of whistleblowing cases

| Year | Number of cases |

|---|---|

| 2022/21 | 0 |

| 2021/22 | 4 |

| 2022/23 | 7 |

NRW as a Prescribed Person for Whistleblowing

NRW became a became a ‘Prescribed Person’ in 2020 following an approach from WG. The Prescribed Persons Order 2014 sets out a list of 60 organisations that any member of the public may approach to report suspected or known wrongdoing (whistleblowing). The organisations and individuals on the list have usually been designated as a prescribed person because they have an authoritative or oversight relationship with their sector, often as a regulatory body. The Order is amended, by the UK Government, each year, to ensure that the list remains up to date.

There were 9 cases of a Prescribed Person Whistleblowing Report received from 1 April 2022 to 31 March 2023, although it is acknowledged other concerns may have been raised outside of the formal whistleblowing process.

Of those 9 cases received, 1 was handled formally as a whistleblowing case but was not upheld. The remaining 8 cases were referred to the incident handling teams within NRW and handled under the normal complaints processes, as none were of the magnitude or severity to require a formal whistleblowing investigation.

Fraud

Our Counter Fraud Strategy 2022 – 2026 sets out the strategic direction designed to support and strengthen NRW’s ability to protect itself from the harm that fraud can cause. Focusing this strategy on best practices and professional standards will help ensure that an anti-fraud approach becomes integral to the way we work. Our Counter Fraud Strategy is supported by a revised Counter Fraud, Bribery and Corruption Policy and a Fraud, Bribery, and Corruption Response Procedure.

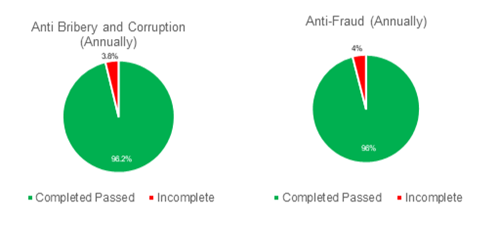

We remain in a cost of living crisis and pressures such as those caused by high rates of inflation can lead to an increased risk of fraud, which is already the most frequently reported category of crime in the UK. Mandatory online learning courses are provided for staff on Anti-Fraud and Anti-Bribery and Corruption. These courses are designed to help staff identify red flags and ensure they are aware of their professional responsibilities. The completion rates for these modules remain high.

eLearning Completion Stats for 2022/2023

As part of our prevention and detection work, risk assessments have been undertaken to identify the areas of the organisation at greatest risk of fraud and to focus our mitigating controls here. We also participate in the National Fraud Initiative, a data matching exercise designed to detect fraud and error across payments systems.

Last year we received 8 allegations of fraud, handled per NRW’s anti-fraud, bribery, and corruption process. These are reported to our Audit and Risk Assurance Committee. All investigations have been managed by an Accredited Counter Fraud Specialist or similarly qualified external investigators. The final report on each case is referred to independent senior staff.

Number of allegations reported

| Year | Allegations |

|---|---|

| 2020/21 | 10 |

| 2021/22 | 8 |

| 2022/23 | 5 |

Whilst robust counter fraud arrangements are part of the NRW response, we also have a responsibility to support our employees and their families. Accordingly, colleagues in People Services continue to work on a range of initiatives to support anyone struggling financially and offer help where we can.

Compliance with the UK Corporate Governance Code

We have completed a basic review and established that our organisational structure, policies, and procedures are set in line with the UK Corporate Governance Code.

Our leadership is consistent with expected senior management roles and responsibilities; supporting procedures are in place to ensure Board roles can operate effectively; our reporting routes are clear to ensure accountability and appropriate division of duties and key internal controls are in place; remuneration of senior staff is considered by nonexecutives to ensure independence and we have regular meetings with our key stakeholders to maintain constructive working relationships.

Our Assurance Framework

Our assurance framework comprises of the following measures which are in place to ensure I receive timely evidence that the controls required are in place and working appropriately.

Internal Audit

The Head of Internal Audit offered a moderate overall assurance opinion for the past year with the caveat that it is borderline and there needs to be further development of NRW’s governance, risk and control to maintain an established moderate internal audit opinion.

The annual audit opinion is based on the following information:

- Outcomes of the engagements on the 2022/23 Internal Audit Plan;

- Management’s completion of the internal audit recommendations as tracked following the completion of audits;

- Cumulative knowledge gained from attendance at management committees; access to risk registers and key documentation; and discussions with management;

- Fraud, bribery, whistleblowing and corruption reports and investigations;

- The internal control checklists completed by the organisation; and

- Other sources of assurance, including the work of:

- Audit Wales,

- ISO accreditations, and

- UKWAS audits.

Opinion

On the balance of the 2022/23 internal audit work, review over strategic risks and evidence gathered on the governance, risk and control within NRW, the Head of Internal Audit offered a Moderate Assurance Opinion in respect for the year.

In conclusion, the Head of Internal Audit’s professional evaluation of internal controls, governance and risk management has led them to conclude that in 2022/23 there remain some improvements required to enhance the adequacy and effectiveness of the framework of governance, risk management and control.

Considering the opinion readers should note the following:

- The opinion is a very borderline moderate and there are considerable improvements required to establish this moderate opinion.

- This opinion is based solely upon the areas taken into consideration and identified above.

- Assurance can never be absolute, neither can internal audit’s work be designed to identify or address all weaknesses that might exist.

- Responsibility for maintaining adequate and appropriate systems of governance, risk management and internal control resides with the NRW’s management and not internal audit.

External audit

Independent scrutiny forms an important source of assurance, providing evidence of our ways of working in relation to best practice and industry standards. In some parts of the organisation, we are subject to, or we opt for, external audits or reviews of our work. Some are annual, for example UK Woodland Assurance Scheme or the ISO14001:2015 to maintain our environmental management system. Others we request as one of many pieces of work to give ourselves further information about particular areas or activity.

Effectiveness of internal controls

To provide assurance that the framework of internal controls is in place and working well within NRW, members of the Executive Team and Heads of Business each completed an Internal Controls Checklist (ICC) and signed a Certificate of Assurance. This required them to make an evidence-based assessment of the effectiveness of the control framework in place for their Directorate/Business Board, attributing an assurance grading of between substantial and unsatisfactory covering NRW’s key risk areas, as set out in our strategic risk register.

This year we undertook a revised process for the completion of the annual ICC process by Directors and Heads of Business. The revised process built upon the existing one, introducing staff and leadership surveys in relation to control effectiveness, to complement the evidence base upon which assessments of assurance were made. The evidence used spanned the second and third lines and sought to drive rich discussions around control effectiveness. Due to this being the first year of completion with the revised process being used, we are unable to make direct comparison to the results obtained from the 2021/2022 ICC analysis.

Heads of Business and Directors attributed similar levels of assurance across most areas, indicating that there is a commonality to the areas where assurance as to the effectiveness of internal controls is substantial, and where it is less satisfactory.

The ET have considered and moderated the analysis of the results and the assurance gradings attributed by Directors and Heads of Business. The results of the analysis of the effectiveness of the system of internal control, as informed by the ICC process, are set out below against NRW’s key strategic risks, including, where relevant, any significant weaknesses identified and the steps taken/proposed to address them.

Wellbeing, Health and Safety

Across both Business Board and Directorate results, Wellbeing, Health and Safety (WHS) was generally assessed to be managed well across the breadth of the organisation. Positive features of the internal control framework include a regular focus and discussion on WHS at monthly Directorate, Manager, and Team meetings. There are good structures in place to ensure staff can be supported while working from home and within NRW offices and sites. E-learning compliance is high in this area, along with Display Screen Equipment checks, Sgwrs (appraisal) meetings, active monitoring, and risk assessments. NRW has also held retention of ISO 45001 and the Silver Standard for the Corporate Health Check. Further improvements could be made in relation to stress management and individual WHS responsibilities, which should be a focus for the upcoming year.

Setting Strategic Direction

Other areas of substantial assurance identified from the staff and leadership surveys include the organisation’s ability to set and communicate a meaningful strategic direction.

There is a good understanding of the direction of the organisation, however links connecting the Corporate, Business, and Services plans with Directorate priorities could be made stronger. Using Sgwrs meetings to make the link between the strategic ambition contained within the Corporate Plan and every individual staff member’s contribution that, along with the associated behaviours, vison, and mission, is to be encouraged.

It is evident that significant work has taken place throughout the year to develop NRW’s new Corporate Plan to 2030, 'Nature and People Thriving Together', which was launched on 28 March 2023. The new plan sets out the organisation’s vision, mission, values, and wellbeing objectives, and evidence shows that engagement with staff on this work has been beneficial and impactful and therefore it is hoped that this will have a positive impact on the control effectiveness in this area going forward.

Championing SMNR

There is a sense from the staff and leadership surveys that the SMNR is now well understood and embedded across the organisation and is being used as a lens to share advice with others on policy, programmes, and legislation. The introduction of high-quality training and induction sessions have broadened the understanding of the need to champion SMNR and have challenged staff to apply the SMNR principles and ways of working to their specific work areas and individual roles. It was recognised that this can be particularly challenging for some roles and services, particularly those that are core, internal-facing services. To provide further assurance around our controls in this area, there will need to be a continued focus on ensuring all decisions are considered from an SMNR perspective.

Management of Incidents

Effective Incident Management was identified as an area where further improvements to controls could be made, such as training for incident roles, ensuring incident rotas are fully populated, as well as business continuity practice exercises becoming routine. It was noted that there can be a lack of clarity in some areas on what constitutes an incident and where the responsibilities lie for ongoing long-term issues/incidents.

Up to date Business Continuity Plans suggest good awareness and understanding of their content across the business. However, controls about lessons learned, recording trends, and developing strategy could be strengthened.

People

Workforce planning and succession planning issues were areas of concern for many. Fundamental weaknesses at an organisational level, linked to a lack of appropriate systems (e.g. Learning Management System) and resourcing (e.g. in relation to staffing) were highlighted. In particular at Directorate level, there is a need to focus on succession planning and career development to provide greater assurance. The resourcing pressures, as well as non-staff budgets, will continue to present challenges to the organisation unless they are addressed over the course of the coming year.

The results of the staff and leadership surveys have highlighted good line management engagement, familiarity with Human Resource (HR) policies and processes, and good compliance with e-learning. However, it also highlighted that the engagement and communication from a Directorate perspective could be improved, and further work is required to improve and embed these practices.

Finance and financial management

Issues with a number of the controls relating to the funding settlement and financial management were highlighted as an area of concern, particularly within Business Boards. It was suggested that control frameworks may not be operating effectively to mitigate key risks arising from the uncertainty of sufficient funding to deliver core organisational functions. This can be reflected in areas of overspend, which could suggest that controls throughout the year were not adequate to stop this happening.

Additionally, significant growth in the organisation’s headcount has left areas within some Directorates receiving little, if any, increase in their budget to provide additional support. Poor line of sight for budgets was stressed as an issue, along with the Service Level Agreement (SLA) process and, separately, the difficulty found in managing the year-end forecast where actual expenditure appeared to be significantly ahead of forecast.

Control areas that were noted to be strong include that there is good compliance overall with mandatory financial and budget management training and awareness of spotting and reporting fraud, as well as understanding of the key policies and processes, is high. However, an area of weakness was identified in relation to a lack of training for those involved in procurement activities, and additional training should be a focus for the coming year across both Business Boards and Directorates.

Compliance

The information gathered from the staff and leadership surveys suggest a good understanding and awareness of risk management purpose and processes, declarations of interest and other key governance policies such as our financial and non-financial schemes of delegation, and policy and procedure around how to report whistleblowing concerns.

There are, however, areas where knowledge and understanding could be strengthened or refreshed, such as data and records management. It was also identified that some compliance controls can be too burdensome and need to be streamlined to ensure that barriers, or perceived barriers to compliance, due to their complexity and detail, are addressed. Whilst it is felt that compliance is improving in several key areas, there are still areas exposing weaknesses across the organisation, for example, limited management information exposing weaknesses in our 2nd line of assurance. Developing a broader assurance framework for the organisation should remain a priority for the coming year, as well as creating leaner processes to support compliance whilst not detracting staff from delivering the Wellbeing Objectives.

Strategic Asset Management

The ownership and use/application of controls in this area were limited to one Directorate and selected Business Boards. Across the four business areas there was a general consensus that good and established practices around asset management processes are in place. It was highlighted that controls in regard to the risk are bedding in well and that there are high quality communications between teams.

However, it was noted that there are several shortcomings in the management information and quality of data, with available information frequently out of date, and this should be an area of focus for the coming year.

- Clare Pillman, Chief Executive and Accounting Officer - 18 October 2023

Remuneration and Staff Report (audited)

Remuneration policy

The Board has established a People and Remuneration Committee to consider matters relating to the pay and conditions of employment of the most senior staff and overall pay strategy for all staff employed by NRW. The People and Remuneration Committee comprises four non-executive Board members. The Board Chair is an ex-officio member of the Committee.

The Chair and Board members’ remuneration is set by Welsh Ministers. The terms of contract for senior employees (ET members) are based on NRW terms and conditions. The remuneration policy for the most senior staff is not subject to collective bargaining and the remuneration package by reference to the utilisation of the Job Evaluation for Senior Posts (JESP) and a spot salary. The pay is increased by the same percentage as Grade 11 (the most senior non-director pay grade).

There is a social partnership agreement in place with five trade unions and the setting of terms and conditions for staff below the ET members is through collective agreement with the social partners. The WG approves any changes to pay, terms and conditions and gives a pay remit to NRW within which it must deliver. This year’s pay was for the period 1 June 2022 to 31 March 2023 and saw a 4% increase to our paybill. For Grades 1 and 2 they received a pay increase of more than 10%, for Grades 3 to 4: £1,400 increase (6.91% to 4.56%) Grade 5: ranging from 4.4% to 3.8% and for Grades 6 and above, 3.65%. The Enhancements and Payments (excluding Loyalty Award) were also increased by 4% from 1 June 2022. This offer did not apply, as already agreed through Job Evaluation consultation, to those who had previously opted out of the Job Evaluation Scheme.

NRW continues to be a Real Living Wage accredited employer. Although the new rates are published in November we always apply the increase to the basic salary from the start of the current pay award period immediately. However, this year our pay offer meant our Grade 1 pay was above the Real Living Wage Foundations recommendation.

Service contracts

All appointments to the Board are made on behalf of NRW’s sponsor minister in WG.

The Chief Executive and ET members are expected to be employed under permanent contracts. Appointments are made in accordance with our recruitment policy, which requires appointment to be made on merit and based on fair and open competition.

Unless otherwise stated below, the ET members covered by this report hold appointments which are permanent. These officers and Board members are required to provide three months’ notice of their intention to leave.

Salary and pension entitlements

The following sections provide details of the remuneration of members of the Board and the remuneration and pension interests of members of the ET. Board members are not entitled to join the Civil Service Pension Scheme or receive other benefits. Early termination, other than for misconduct, would result in the ET members receiving compensation consistent with the Civil Service Compensation Scheme. Board members are not entitled to compensation.

Board members’ remuneration

|

Board Member |

Contracted Dates |

Salary 2022/23 (£5,000 range) |

Salary 2021/22 (£5,000 range) |

|---|---|---|---|

|

Karen Balmer |

09/11/15 to 31/03/23 |

10-15 |

10-15 |

|

Catherine Brown |

01/11/18 to 31/10/22 |

5-10 |

15-20 |

|

Julia Cherrett |

01/11/18 to 31/05/23 |

15-20 |

15-20 |

|

Geraint Davies |

01/01/19 to 31/10/24 |

10-15 |

10-15 |

|

Howard Davies |

09/11/15 to 31/08/21 |

N/A |

10-15 |

|

Peter Fox |

16/02/23 to 31/10/26 |

0-5 |

N/A |

|

Paul Griffiths |

01/09/21 to 25/05/22 |

0-5 |

5-10 |

|

Elizabeth Haywood |

09/11/15 to 31/08/21 |

N/A |

15-20 |

|

Sir David Henshaw (Chair) |

01/11/18 to 31/10/25 |

45-50 |

45-50 |

|

Zoë Henderson |

09/11/15 to 08/05/23 |

10-15 |

15-20 |

|

Calvin Jones |

01/09/21 to 31/10/28 |

10-15 |

5-10 |

|

Rhys Jones |

16/02/23 to 31/10/27 |

0-5 |

N/A |

|

Mark McKenna |

01/09/21 to 31/10/28 |

10-15 |

5-10 |

|

Steve Ormerod (Deputy Chair) |

01/11/18 to 31/10/25 |

15-20 |

15-20 |

|

Kathleen Palmer |

16/02/23 to 31/10/26 |

0-5 |

N/A |

|

Helen Pittaway |

16/02/23 to 31/10/26 |

0-5 |

N/A |

|

Rosie Plummer |

01/11/18 to 31/10/24 |

15-20 |

15-20 |

|

Peter Rigby |

01/11/18 to 31/10/23 |

15-20 |

25-30 |

Table notes:

- Karen Balmer became chair of the Audit and Risk Assurance Committee on 1 November 2022 until her board membership ceased on 31 March 2023.

- Catherine Brown was chair of the Audit and Risk Assurance Committee until her board membership ceased on 31 October 2022.

- Julia Cherrett was chair of the Flood Risk Management Committee until 23 March 2023 and chair of People and Customer Committee until 23 March 2023.

- Howard Davies ceased to be a board member on 31 August 2021 and was chair of the Protected Areas Committee until this date. He received remuneration within the range of £5,000 to £10,000 for services during 2021/22 and backpay for services as chair of Protected Areas Committee during previous financial years of £5,000 to £10,000. The total remuneration for 2021/22 was £10,000 to £15,000.

- Peter Fox was appointed to the board on 16 February 2023 and became chair of Flood Risk Management Committee on 23 March.

- Paul Griffiths became a board member on 1 September 2021 and resigned on 25 May 2022.

- Elizabeth Haywood ceased to be a board member on 31 August 2021 and was chair of the Flood Risk Management Committee until this date. She received remuneration within the range of £5,000 to £10,000 for services during 2021/22 and a backpay for services as chair of the Flood Risk Management Committee during previous financial years of £10,000 to £15,000. The total remuneration for 2021/22 was £15,000 to £20,000.

- Sir David Henshaw is chair of the Board and was interim chair of the Finance Committee until 23 March 2023.

- Zoë Henderson was chair of the People and Remuneration Committee until 31 March 2022.

- Calvin Jones became a board member on 1 September 2021 and became chair of Land Estate Committee on 22 September 2022.

- Rhys Jones was an associated board member (with remuneration) from 16 February 2023 and became a full member and chair of Welsh Land Management Forum on 9 May 2023.

- Mark McKenna became a board member on 1 September 2021 and appointed as chair of People and Customer Committee on 23 March 2023.

- Steve Ormerod is deputy chair of the Board.

- Kathleen Palmer was an associated board member (with remuneration) from 16 February 2023 and became a full member and chair of ARAC on 1 April 2023.

- Helen Pittaway was appointed to the board on 16 February 2023 and became chair of Finance Committee on 23 March 2023.

- Rosie Plummer has been chair of the Protected Areas Committee since 31 August 2021.

- Peter Rigby is chair of Evidence Advisory Committee. He received remuneration within the range of £15,000 to £20,000 for services during 2021/22 and a backpay for services as chair of the Evidence Advisory Committee during previous financial years of £5,000 to £10,000. The total remuneration for 2021/22 was £25,000 to £30,000.

Executive Team’s remuneration 2022/23

|

Executive Team Member |

Salary (£5,000 range) 2022/23 |

Benefits in kind (nearest £100) 2022/23 |

Pension benefits (nearest £1,000) 2022/23 |

Total (£5,000 range) 2022/23 |

|---|---|---|---|---|

|

Clare Pillman (Chief Executive) |

145-150 |

0 |

negative 10,000 |

135-140 |

|

Rachael Cunningham |

115-120 |

0 |

21,000 |

140-145 |

|

Ceri Davies |

115-120 |

0 |

negative 2,000 |

115-120 |

|

Prys Davies |

100-105 |

0 |

10,000 |

110-115 |

|

Sarah Jennings |

120-125 |

0 |

49,000 |

170-175 |

|

Gareth O’Shea |

110-115 |

0 |

negative 48,000 |

60-65 |

Executive Team’s remuneration 2021/22

|

Executive Team Member |

Salary (£5,000 range) 2021/22 |

Benefits in kind (nearest £100) 2021/22 |

Pension benefits (nearest £1,000) 2021/22 |

Total (£5,000 range) 2021/22 |

|---|---|---|---|---|

|

Clare Pillman (Chief Executive) |

140-145 | 0 | 23,000 | 160-165 |

| Rachael Cunningham | 115-120 | 0 | 76,000 | 190-195 |

| Ceri Davies | 105-110 | 0 | 6,000 | 115-120 |

| Prys Davies | 110-115 | 0 | 26,000 | 135-140 |

| Sarah Jennings | 120-125 | 0 | 47,000 | 165-170 |

| Gareth O’Shea | 120-125 | 0 | 93,000 | 215-220 |

Executive team's remuneration notes:

- Prys Davies’s full year equivalent salary for 2021/22 was £95,000 to £100,000. During that year, he received a back dated increase to salary which resulted in additional pay of £10,000 to £15,000 in relation to financial year 2020/21.

- Gareth O’Shea’s full year equivalent salary for 2021/22 was £105,000 to £110,000. During that year, he received a back dated increase to salary which resulted in additional pay of £15,000 to £20,000 in relation to financial years 2020/21 and 2019/20.

- The value of pension benefits accrued during the year is calculated as the real increase in pension multiplied by 20, plus the real increase in any lump sum, less contributions made by the individual. The real increase is calculated by deducting the opening valuation from the end valuation. The real increases exclude increases due to inflation or any changes due to a transfer of pension rights. Inflationary increases are excluded by applying a real increase factor to the value at the start of the year.

For changes in levels of pay, the increase in pension due to additional service may not be sufficient to offset the inflation increase – that is, in real terms, the pension value can reduce, hence the negative values.

This value does not represent an amount that will be received by the individual. It is a calculation that is intended to convey to the reader of the accounts an estimation of the benefit that being a member of the pension scheme could provide. The pension benefit table provides further information on the pension benefits accruing to the individual.

Salary

Salary covers both pensionable and non-pensionable amounts and includes gross salary, overtime and any allowances or payments that are subject to UK taxation. It does not include amounts which are a reimbursement of expenses directly incurred in the performance of an individual’s duties.

Performance-related pay

Any increase in salary is subject to performance being assessed as either ‘Outstanding’ or ‘Achieving’ by the Chief Executive and moderation by the People and Remuneration Committee. The increase applied will be determined by the pay award applied for those within the collective bargaining unit. Where performance is deemed to be underperforming then no pay increase is applied

Benefits in kind

The monetary value of benefits in kind covers any benefits provided by the employer and treated by the HM Revenue & Customs as a taxable emolument. None of the Board members or ET received benefits in kind during 2022/23 and 2021/22.

None of the Board members or senior staff received any remuneration other than the amounts shown above.

Pension benefits

|

Executive Team member |

Accrued Pension at pension age as at 31/03/23 (£000) |

Accrued Lump Sum at pension age as at 31/03/23 (£000) |

Real Increase in pension at pension age (£000) |

Real Increase in Accrued Lump Sum at pension age (£000) |

CETV at 31/03/23 (£000) |

CETV at 31/03/22 (£000) |

Real Increase in CETV (£000) |

|---|---|---|---|---|---|---|---|

|

Clare Pillman (Chief Executive) |

65-70 |

135-140 |

0-2.5 |

0 |

1,387 |

1,261 |

negative 30 |

|

Rachael Cunningham |

35-40 |

0 |

0-2.5 |

0 |

575 |

513 |

3 |

|

Ceri Davies |

55-60 |

75-80 |

0-2.5 |

negative 2.5-0 |

1,149 |

1,017 |

negative 9 |

|

Prys Davies |

35-40 |

60-65 |

0-2.5 |

0 |

613 |

553 |

negative 5 |

|

Sarah Jennings |

5-10 |

0 |

2.5-5 |

0 |

103 |

60 |

31 |

|

Gareth O’Shea |

60-65 |

95-100 |

negative 2.5-0 |

negative 7.5-negative 5 |

1,139 |

1,046 |

negative 51 |

The final salary pension of a person in employment is calculated by reference to their pay and length of service. The pension will increase from one year to the next by virtue of any pay rise during the year. For changes in pay, the increase in pension due to extra service may not be sufficient to offset the inflation increase – that is in real teams, the pension value can reduce, hence the negative values.

Cash Equivalent Transfer Values (CETV)

A Cash Equivalent Transfer Value (CETV) is the actuarially assessed capitalised value of the pension scheme benefits accrued by a member at a particular point in time. The benefits valued are the member’s accrued benefits and any contingent spouse’s pension payable from the scheme. A CETV is a payment made by a pension scheme or arrangement to secure pension benefits in another pension scheme or arrangement when the member leaves a scheme and chooses to transfer the benefits they have accrued in their former scheme. The pension figures shown relate to the benefits that the individual has accrued as a consequence of their total membership of the pension scheme, not just their service in a senior capacity to which disclosure applies.

The figures include the value of any pension benefit in another scheme or arrangement which the member has transferred to the Civil Service pension arrangements. They also include any additional pension benefit accrued to the member as a result of their buying additional pension benefits at their own cost. CETVs are worked out in accordance with The Occupational Pension Schemes (Transfer Values) (Amendment) Regulations 2008 and do not take account of any actual or potential reduction to benefits resulting from Lifetime Allowance Tax which may be due when pension benefits are taken.

Real increase in CETV

This reflects the increase in CETV that is funded by the employer. It does not include the increase in accrued pension due to inflation or contributions paid by the employee (including the value of any benefits transferred from another pension scheme or arrangement) and uses common market valuation factors for the start and end of the period.

Compensation for loss of office

No compensation for loss of office was agreed during 2022/23.

Fair pay disclosure

NRW and similar bodies are required to disclose the relationship between the remuneration of the highest paid director in their organisation and the median remuneration of the organisation’s workforce. Total remuneration includes salary and benefits in kind where applicable. It does not include severance payments, employer pension contributions and the CETV.

In 2022/23, 3 contract staff (2021/22: 3) were charged at a rate in excess of the highest-paid director.

The banded remuneration of the highest paid director (as shown above) in the financial year 2022/23 was £145,000 to £150,000 (2021/22: £140,000 to £145,000). This was 3.8 times (2021/22 3.8 times) the median remuneration of the workforce, with comparison in respect of upper, median, and lower quartile remuneration presented in the following table.

Included in the tables below are permanent employees, fixed term appointments, apprentices, secondees, agency staff and contractors, where the pay has been calculated on an annualised basis, as required by the Financial Reporting Manual.

Workforce pay ratio

|

Workforce pay ratio |

2022/23 (£) |

2021/22 (£) |

Movement (%) |

|---|---|---|---|

|

Upper quartile |

46,003 |

42,885 |

7.27 |

|

Ratio |

3.2 |

3.3 |

N/A |

|

Median |

38,492 |

37,119 |

3.70 |

|

Ratio |

3.8 |

3.8 |

N/A |

|

Lower quartile |

32,876 |

31,490 |

4.40 |

|

Ratio |

4.4 |

4.4 |

N/A |

Staff pay scales range from £21,655 to £72,627 (2021/22: £19,100 to £70,070).

The percentage increase in salary, benefits in kind and performance related pay during the year was:

| Staff |

Movement % |

|---|---|

| Highest paid director | 3.65 |

| All staff | 4.31 |

Staff report

This report provides information on the composition and costs of our workforce. Included in the staff tables below are permanent employees, fixed-term appointments, apprentices as well as agency staff, contractors, secondees.

Number of staff by headcount and full time equivalent (FTE) at 31 March 2023

Male:

| Employees | Headcount | FTE |

|---|---|---|

| All employees | 1,391 | 1,364 |

| Leadership Team | 13 | 13 |

| Executive Team | 2 | 2 |

Female:

| Employees | Headcount | FTE |

|---|---|---|

| All employees | 1,168 | 1,097 |

| Leadership Team | 14 | 13.5 |

| Executive Team | 4 | 4 |

Total:

| Employees | Headcount | FTE |

|---|---|---|

| All employees | 2,559 | 2,461 |

| Leadership Team | 27 | 26.5 |

| Executive Team | 6 | 6 |

Number of staff by headcount and full time equivalent (FTE) at 31 March 2022

Male:

| Employees | Headcount | FTE |

|---|---|---|

| All employees | 1,364 | 1,331 |

| Leadership Team | 11 | 10 |

| Executive Team | 2 | 2 |

Female:

| Employees | Headcount | FTE |

|---|---|---|

| All employees | 1,102 | 1,028 |

| Leadership Team | 14 | 12.5 |

| Executive Team | 4 | 4 |

Total:

| Employees | Headcount | FTE |

|---|---|---|

| All employees | 2,466 | 2,359 |

| Leadership Team | 25 | 23 |

| Executive Team | 6 | 6 |

Average number of full-time equivalent persons paid during the year was:

|

Full-time equivalent persons paid |

Permanent Staff (2022/23) |

Others (2022/23) |

Total (2022/23) |

Total (2021/22) |

|---|---|---|---|---|

| Directly employed |

2,180 |

52 |

2,232 |

2,144 |

|

Agency and contract staff |

0 |

158 |

158 |

164 |

|

Total |

2,180 |

210 |

2,390 |

2,308 |

The average full-time equivalent number of staff working on capital projects was

246.1 (2021/22: 232.2).

Staff turnover

Staff turnover during 2022/23 was 5.8% excluding temporary workers e.g. fixed term appointments (2021/22 6.75%).

Staff costs

|

Staff costs and other expenditure for staff |

Permanent staff - 2022/23 |

Other (£'000) |

Total - 2022/23 (£'000) |

Total - 2021/22 (£'000) |

|---|---|---|---|---|

|

Wages and salaries |

85,281 |

13,290 |

98,571 |

93,123 |

|

Social security costs and other taxation |

9,622 |

558 |

10,180 |

8,971 |

|

Other pension costs |

21,578 |

400 |

21,978 |

20,415 |

|

Total net salary costs |

116,481 |

14,248 |

130,729 |

122,509 |

|

Exit package costs |

N/A |

N/A |

81 |

159 |

|

IAS 19 (pensions) service charge |

N/A |

N/A |

14,855 |

16,353 |

|

Less early retirement pension costs |

N/A |

N/A |

78 |

negative 15 |

|

Less in-year LGPS pension contributions |

N/A |

N/A |

Negative 6,894 |

Negative 6,894 |

|

Movement in accrued holiday pay |

N/A |

N/A |

138 |

Negative 140 |

|

Total other expenditure for staff |

N/A |

N/A |

8,258 |

Negative 9,463 |

|

Less amounts charged to capital projects |

N/A |

N/A |

Negative 14,136 |

Negative 12,757 |

|

Total staff costs |

N/A |

N/A |

124,851 |

119,215 |

More details of NRW's pension obligations can be found in Note 15 of the Financial statements and notes to the accounts.

Details of the remuneration of Board members and directors are in the remuneration report. Bought-in services in Note 5 (other expenditure) includes £14.7 million of expenditure on consultants (2021/22 £11.3 million).

Pension schemes

NRW is a member of two pension schemes. The Principal Civil Service Pension Scheme (PCSPS) is an open scheme and includes both the defined benefit scheme, Alpha, as well as the stakeholder partnership defined contribution scheme. NRW is also a closed member of the Environment Agency Pension Fund (EAPF) under a community admission agreement. Further details of these pension schemes are shown below.

Civil Service Pension Scheme contributions

The PCSPS and the Civil Servant and Other Pension Scheme (CSOPS) - known as "Alpha" - are unfunded multi-employer defined benefit schemes, but the schemes do not identify individual organisations’ share of the underlying assets and liabilities. The scheme’s actuary valued the PCSPS as at 31 March 2016. You can find details in the resource accounts of the Cabinet Office: Civil Superannuation at https://www.civilservicepensionscheme.org.uk/knowledge-centre/resources/resource-accounts/

For 2022/23, employer’s contributions of £14,965k were payable to the PCSPS (2021/22: £13,204k) at one of four rates in the range 26.6% to 30.3% of pensionable earnings (for 2020/21 26.6% to 30.3%), based on salary bands. The Scheme Actuary reviews employer contributions usually every four years following a full scheme valuation. The contribution rates are set to meet the cost of the benefits accruing during 2022/23 to be paid when the member retires and not the benefits paid during this period to existing pensioners.

Stakeholder partnership pensions

Employees can opt to open a partnership pension account, a stakeholder pension with an employer contribution. Employer’s contributions of £156k (2021/22: £152k) were paid to the appointed stakeholder pension provider. Employer contributions are age-related and range from 8% to 14.75%.

Employers also match employee contributions of up to 3% of pensionable earnings. In addition, employer contributions of £5k, 0.5% of pensionable pay (2021/22 £5k), were payable to the PCSPS to cover the cost of the future provision of lump sum benefits on death in service or ill health retirement of these employees.

No contributions were due to the partnership pension providers at the balance sheet date, and no contributions were prepaid.

Local Government Pension Scheme contributions

NRW makes payments to the EAPF, as the administering authority for the Local Government Pension Scheme (LGPS) via Capita, the pension fund administrators.

The LGPS is a funded, statutory, defined contribution public service pension scheme. Every three years the EAPF undertakes a valuation in conjunction with the Scheme Actuary. The 31 March 2022 valuation assessed the EAPF financial position with a funding level of 103% (2019: 106%). The main purpose of the actuarial valuation is to review the financial position of the fund and to set the level of future contributions for employers in the fund.

NRW has a community admission agreement with the EAPF to participate in the LGPS, which was approved by the Secretary of State for Communities and Local Government in respect of former Environment Agency Wales staff who transferred to NRW on 1 April 2013. The liabilities for former members employed by the Environment Agency in respect of Welsh functions (pensions in payment and deferred members) also transferred. The WG has entered into a guarantee with the EAPF to indemnify them for any liabilities that arise from the participation of NRW in the EAPF.

For 2022/23 the employer's contribution rate was 23.76% (2021/22: 24.67% from April 2021 and 23.76% from June 2021)

In 2022/23 employer's contributions of £6,894k were paid to the LGPS (2021/22: £6,894k) which reduces the balance on the IAS 19 pension fund.

Exit packages

|

The total number of exit packages by cost band: |

2022/23 |

2021/22 |

|---|---|---|

|

Under £10,000 |

4 |

2 |

|

£10,001 - £25,000 |

2 |

1 |

|

£25,001 - £50,000 |

1 |

0 |

|

£50,001 - £100,000 |

0 |

2 |

|

£100,001 - £150,000 |

0 |

0 |

|

Total |

7 |

5 |

|

Resource cost |

£88,000 |

£159,000 |

There were no compulsory redundancies in 2022/23 or 2021/22.

Voluntary exit costs have been paid in accordance with provisions of the Civil Service Compensation Scheme, a statutory scheme made under the Superannuation Act 1972. The table above shows the total cost of exit packages agreed and accounted for in 2022/23. Included in Exit package costs in the staff costs note above is a prior year accrual of £7k for an employee that was expected to, but has not left during the year. Exit costs of £99k were actually paid in 2022/23, the year of departure. Where NRW has agreed early retirements, the additional costs are met by NRW and not by the Civil Service pension scheme. Ill-health retirement costs are met by the pension scheme and are not included in the table.

Sickness absence (not subject to audit)

Our sickness absence rate for the rolling year (1 April 2022 to 31 March 2023) showed an average of 6.09 days lost per employee and equates to 2.7%.

Disability Policies (not subject to audit)

Disability Confident Employer

During 2022/23, we continue to be compliant with our ‘Two Ticks’ guaranteed interview scheme where applicants who declare themselves as disabled, in line with the Equality Act 2010 definition, and meet the minimum criteria for the role applied for are automatically invited to interview.

Externally we received applications from 4,144 people of which 83 (2%) people requested a guaranteed interview. Internally we received applications from 1,155 people of which 3 (0.25%) people requested a guaranteed interview.

Employee Staff Networks (not subject to audit)

Employee Staff Networks play an important role in supporting colleagues and the organisation. Employee Staff Networks are run by staff for staff; and bring together people from all areas of the workplace who identify with others from a similar background or protected characteristic. Employee Staff Networks can also fulfil various functions including providing opportunities for social interaction, peer support and personal development.

Each Employee Staff Network has a Network Lead, or the role is carried out jointly with another colleague. These roles are carried out voluntarily and provide staff with a contact when support or signposting is required.

As an organisation we value our self-organised Employee Staff Networks in creating an environment that respects the diversity of staff, and enables engagement and enjoyment in the workplace.

We support the Employee Staff Networks by:

- Promoting the Employee Staff Networks to new and existing employees through Induction and the Intranet

- Encouraging managers to release Network Leads to organise and facilitate meetings and events